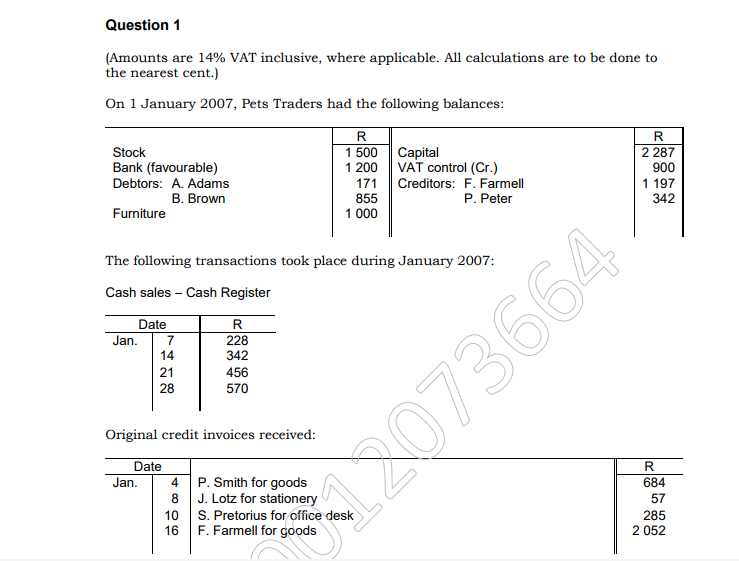

Calculate the VAT inclusive amount if: a) 28 kℓ of water was used. b) 36 kℓ of water was used. - MathsGee Student Support - Expert Verified Instant Help

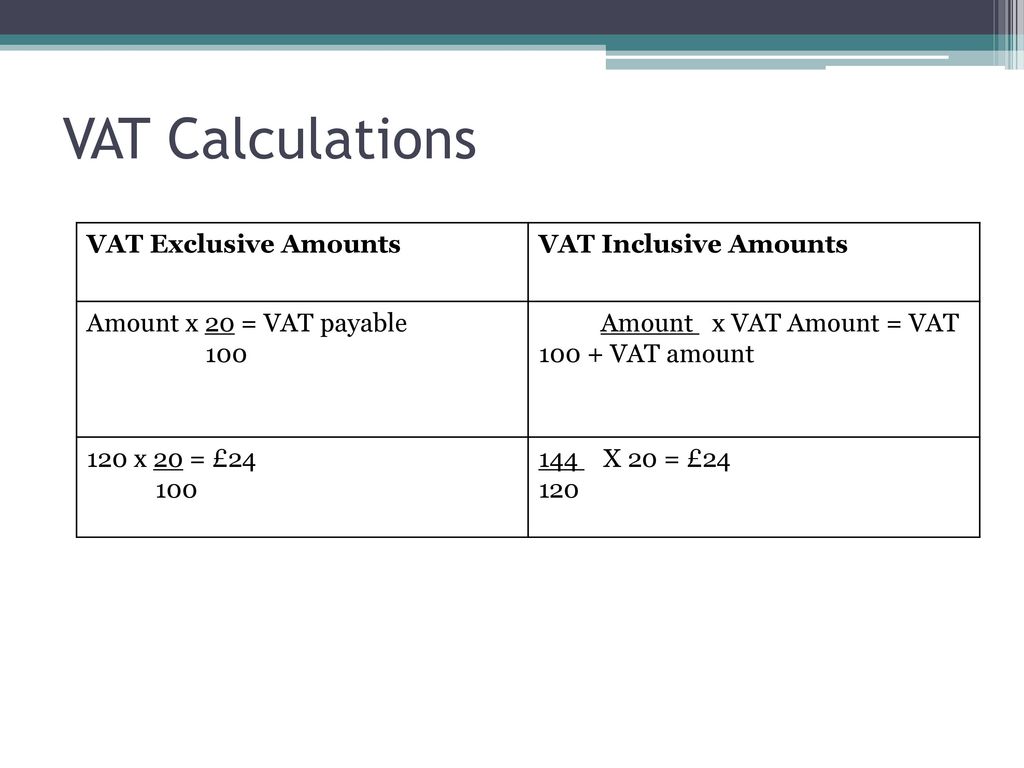

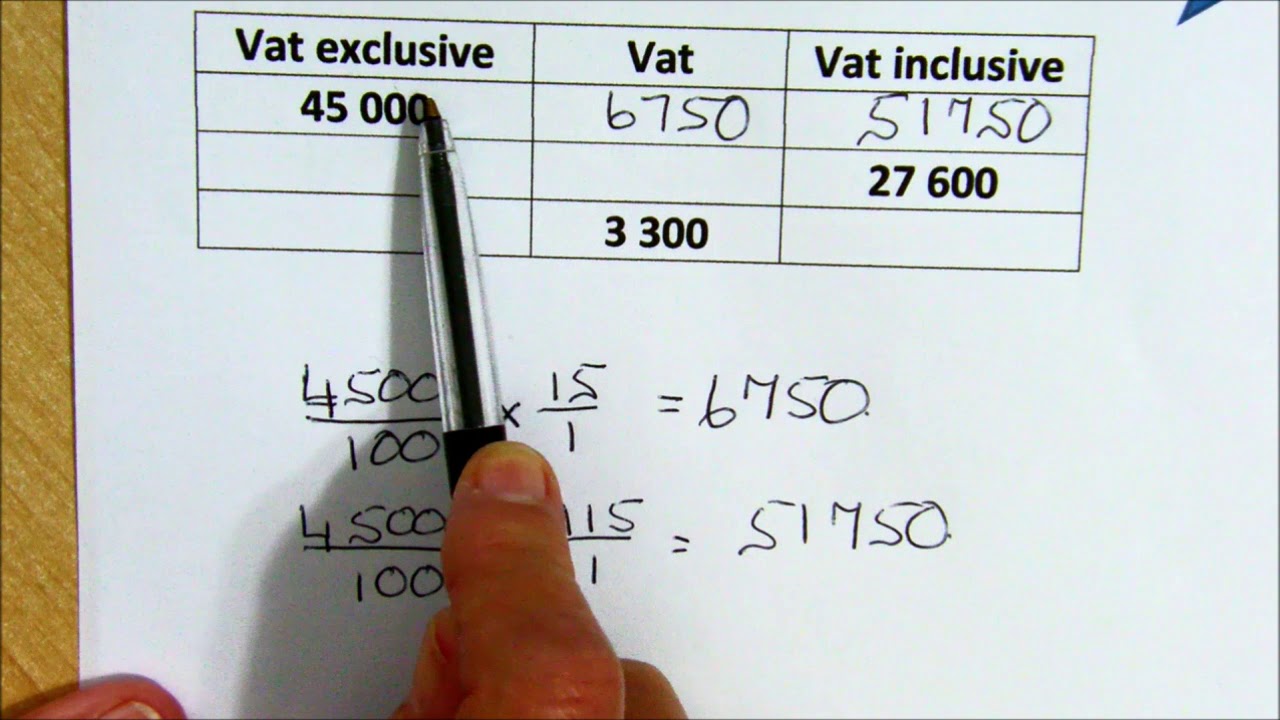

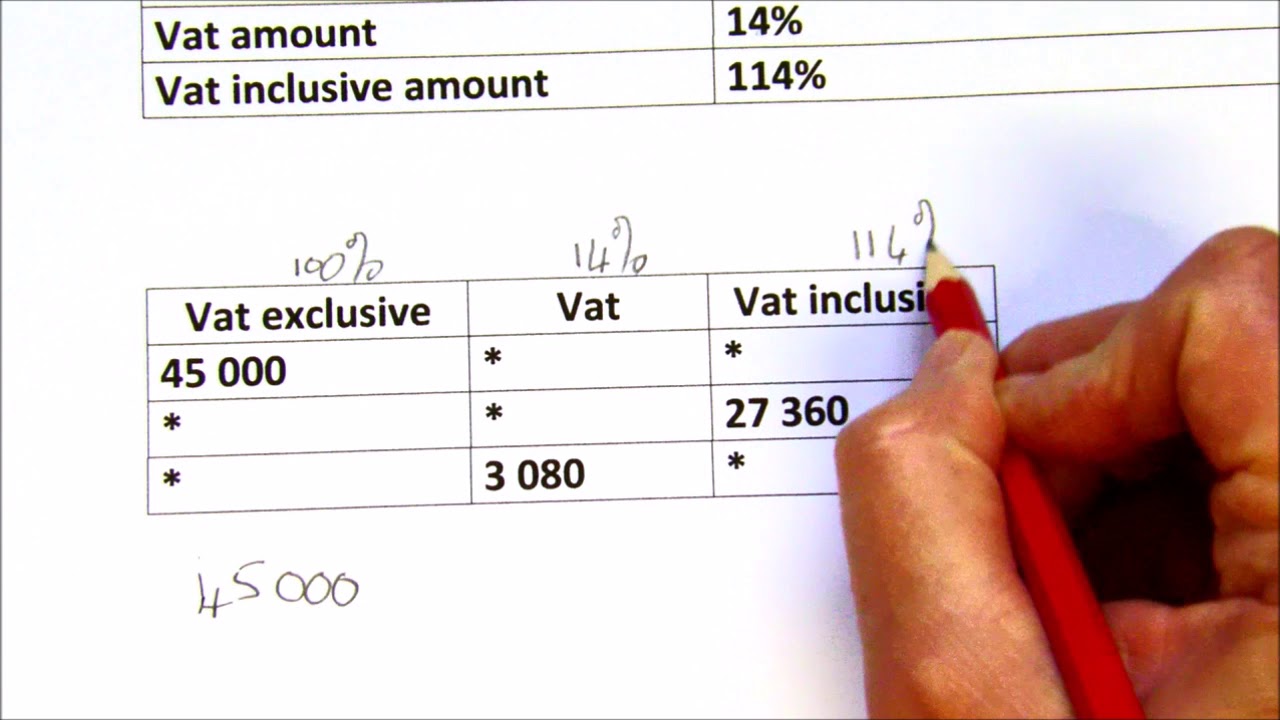

Math-E-Rific - 📢📢Was R30 now R20!! Special valid till Firday, 9 October. Financial Mathematics🤩🤩 3 X A3 Posters! Formula: – VAT INCLUSIVE -VAT EXCLUSIVE – PERCENTAGE PROFIT – PERCENTAGE LOSS – CALCULATE

![Solved Question 2 [14] VALUE-ADDED TAX (VAT) 2.1. Choose the | Chegg.com Solved Question 2 [14] VALUE-ADDED TAX (VAT) 2.1. Choose the | Chegg.com](https://media.cheggcdn.com/media/d3f/d3fbb19f-e863-4be9-8641-d5b06634ce4e/phpvTDktW.png)